| Channel | Publish Date | Thumbnail & View Count | Download Video |

|---|---|---|---|

| | Publish Date not found |  0 Views |

Sanctions compliance is a critical aspect of the anti-money laundering framework and involves restricting the establishment of business relationships with certain individuals and entities that are on the UAE's local terrorist list and the United Nations Security Council consolidated list.

These sanctions lists must be reviewed in the following cases:

1. If there is an update in these lists

2. Before accepting new customers or completing a transaction with an existing customer

3. If customer data changes.

The entire sanctions assessment can be divided into four elements:

First, all natural and legal persons in the UAE must register with the Executive Office for Control & Non-Proliferation (EOCN) to receive updated information on changes to the local terrorist list or the UNSC consolidated list.

Sanctions screening process:

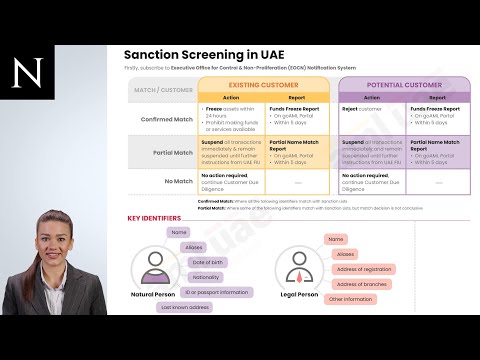

The second aspect of sanctions compliance is screening, which can be done either manually or using AML software based on the following key identifiers:

– Name and aliases

– Nationality,

– Date of birth or foundation,

– Place of foundation.

The review would have three possible outcomes. Depending on these, companies would have to take the necessary measures and define their reporting obligations.

The third critical aspect of implementing sanctions is the action to be taken by the regulated entities. If an existing customer is found to have been sanctioned, the regulated entities will freeze the financial resources of the person concerned and prohibit further provision of the services or funds.

If it turns out that a newly approached customer is subject to sanctions, the company will reject the person in question and not take him or her on board.

In the event of a partial match, where some of the identifiers match but the Company cannot determine whether the person being checked is the same person on the sanctions list, the Company will suspend all business relations with that person (whether new or existing) until it receives further instructions from the Financial Intelligence Unit.

Please note that the action to freeze the funds, suspend the transaction or reject it by the client must be performed within 24 hours after the confirmed or partial match is detected.

The final part of sanctions compliance is timely reporting to the #FIU

In case of confirmed or partial compliance with the sanctions list, the company is obliged to report to the FIU within five working days from the date of the company's action the designated person, freezing measures taken by the company, etc.

Companies should submit the following reports on the goAML portal:

a. Fund Freeze Report (FFR) with confirmed sanction compliance,

b. Partial Name Match Report (PNMR) in cases where some screening identifiers match and the company cannot draw any conclusions on the screening results.

In cases where the sanctions check does not reveal any matches, companies are not required to report anything, but they should maintain this “No Match” result and continue with the due diligence process.

I hope this video helped you understand the sanctions compliance process in the UAE. Stay tuned for more videos on the AML CFT framework in the UAE. For more information, visit our website www.amluae.com or contact us at [email protected].

Time stamp:

0:00 Introduction and cases on sanctions screening

0:47 Executive Office Subscription

1:07 Sanctions screening process

1:36 Implementation process of sanctions

2:36 Timely report to the FIU

2:55 Submitting reports in the goAML portal

3:16 Conclusion

#AMLUAE #uaeaml #sanctionscompliance #goamlportal #uaefiu #amlcdd #eocn #amlcdd #uaefinancialintelligenceunit #uae

Please take the opportunity to connect with your friends and family and share this video with them if you find it useful.